Introduction:

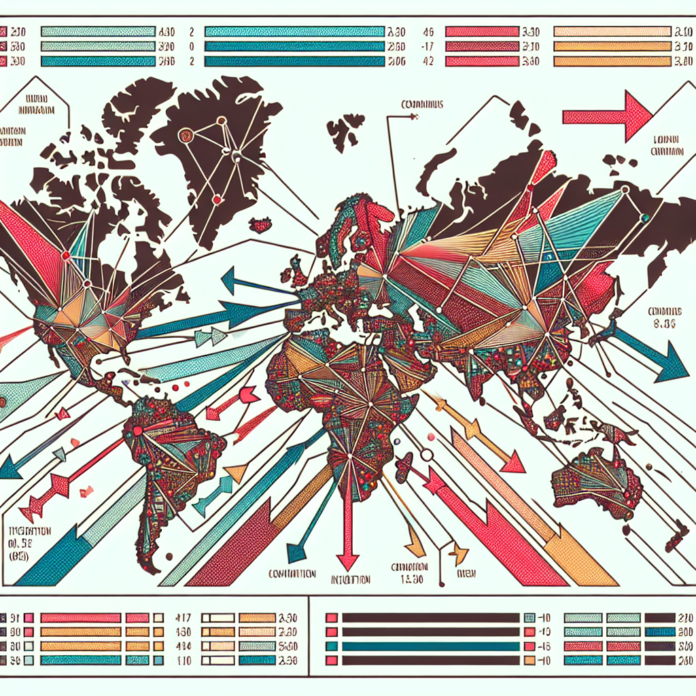

Inflation, the persistent increase in the general price level of goods and services, can have far-reaching effects beyond the borders of individual economies. As major economies experience inflationary pressures, the global interconnectedness of markets and trade means that these effects are not confined to one country alone. In this article, we will explore the global ripple effects of inflation in major economies and provide links to companies that offer insights and solutions in this area.

- Impact on Trade and Exchange Rates:

Inflation in major economies can impact global trade and exchange rates, leading to both opportunities and challenges:

- Currency Depreciation: When a major economy experiences inflation, its currency may depreciate relative to other currencies. This depreciation can make exported goods more competitive in international markets, potentially boosting exports. However, it can also increase the costs of imported goods, contributing to inflation in other countries.

- Trade Imbalances: Inflation in major economies can result in trade imbalances. As the prices of goods and services rise, the demand for imports from countries with lower inflation may increase. This can impact the trade balance and lead to potential disruptions in global supply chains.

To explore the global impacts of inflation on trade and exchange rates, consider the following resources:

- World Trade Organization (WTO): The WTO provides research, reports, and publications on international trade, including insights into the impact of inflation on global trade dynamics and exchange rates.

Website: www.wto.org

- Bloomberg: Bloomberg offers up-to-date news, analysis, and market insights on global trade and exchange rates. Their platform can provide valuable information on the interplay between inflation and international trade.

Website: www.bloomberg.com

- Investor Sentiment and Financial Markets:

Inflation in major economies can have significant implications for investor sentiment and financial markets:

- Interest Rates and Inflation Expectations: Rising inflation may lead central banks to increase interest rates to combat inflationary pressures. Higher interest rates can affect investor behavior, potentially impacting asset prices, borrowing costs, and investment decisions.

- Flight to Safe-Haven Assets: In uncertain times, investors may seek safe-haven assets, such as gold or government bonds, to mitigate the impact of inflation on their portfolios. This flight to safety can have ripple effects on global financial markets.

To gain a deeper understanding of the global ripple effects of inflation on investor sentiment and financial markets, consider the following resource:

- Financial Times: The Financial Times provides comprehensive coverage of global financial news, including insights into how inflation affects investor sentiment and financial market dynamics.

Website: www.ft.com

Conclusion:

Inflation in major economies can have wide-ranging global implications, impacting trade dynamics, exchange rates, investor sentiment, and financial markets. Currency depreciation and trade imbalances can disrupt global trade flows, affecting both exporting and importing economies. Rising inflation can also influence investor behavior and asset prices, potentially causing volatility in financial markets. Resources such as the World Trade Organization and Bloomberg offer valuable insights into the global impacts of inflation on trade and exchange rates, while the Financial Times provides comprehensive coverage of inflation’s effects on investor sentiment and financial markets.

Disclaimer: The external links provided in this article are for reference purposes only, and their inclusion does not signify endorsement or affiliation with the companies mentioned. Always exercise caution when visiting external websites and consult with reputable economic and financial sources for personalized advice on the global effects of inflation in major economies.

AGF-B.CO

AGF-B.CO