Introduction:

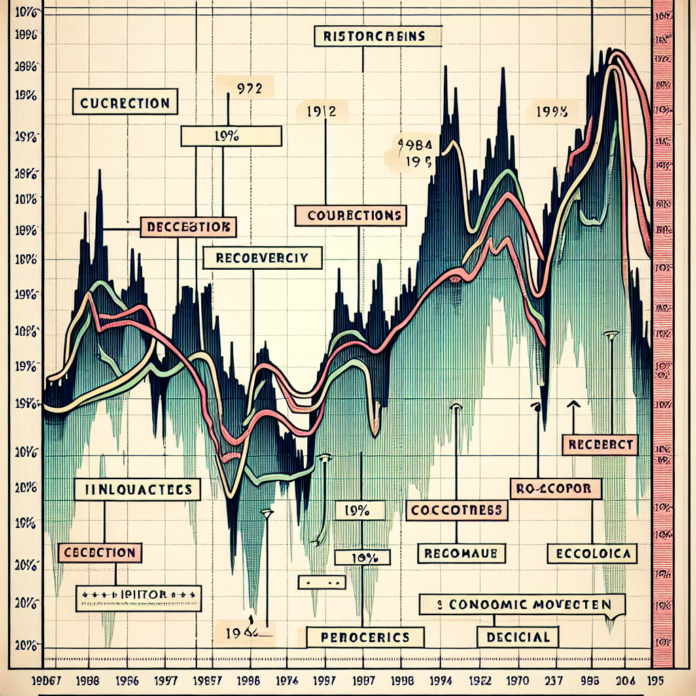

The Dow Jones Industrial Average (DJIA) has witnessed several corrections throughout its history, followed by remarkable recoveries that have defined the resilience and long-term growth of the stock market. Understanding the patterns and lessons from these historical corrections can provide valuable insights for investors navigating the ever-changing market landscape. In this article, we will take a retrospective look at significant Dow Jones corrections and highlight companies that provide historical data to help analyze these events.

- Dow Jones & Company:

Dow Jones & Company, a subsidiary of S&P Global, is a renowned provider of market indices, business news, and historical market data. Their expertise and expansive dataset make them an excellent resource for understanding the historical context of Dow Jones corrections and recoveries. By analyzing their data, investors can gain insights into the duration, severity, and recovery patterns associated with past corrections.

External Link:

- Dow Jones & Company: Visit the official Dow Jones & Company website to access their historical market data and insights, allowing a deeper understanding of past Dow Jones corrections and recoveries.

- Investopedia:

Investopedia, a leading financial education website, offers comprehensive articles and resources covering various aspects of the stock market. Their content includes analysis of historical market events and their impact on the Dow Jones Index. By exploring Investopedia’s resources, investors can gain a broader perspective on the patterns and trends surrounding past corrections and recoveries.

External Link:

- Investopedia: Explore Investopedia’s website to access their articles and resources dedicated to analyzing historical market events, such as Dow Jones corrections and recoveries.

- Federal Reserve Economic Data (FRED):

FRED, provided by the Federal Reserve Bank of St. Louis, offers a vast collection of economic data, including historical stock market information. By accessing FRED’s database, investors can retrieve historical Dow Jones data and explore various indicators surrounding market corrections and recoveries. This data can provide valuable insights into the economic context and factors influencing the Dow Jones Index during those periods.

External Link:

- Federal Reserve Economic Data (FRED): Visit FRED’s website to access their extensive database for historical stock market data, including the Dow Jones Index, enabling in-depth analysis of past corrections and recoveries.

Conclusion:

The historical perspective of Dow Jones corrections and recoveries offers valuable insights into market dynamics and investor behavior. Utilizing resources like Dow Jones & Company, Investopedia, and Federal Reserve Economic Data (FRED) allows investors to analyze past patterns, duration, and recovery trajectory associated with corrections. By understanding these patterns, investors can better navigate future market downturns and make informed decisions based on the lessons learned from history.

AGF-B.CO

AGF-B.CO