The world of cryptocurrency fundraising is witnessing an evolution with the emergence of Decentralized Autonomous Initial Coin Offerings (DAICOs). This innovative model blends the concepts of Decentralized Autonomous Organizations (DAOs) and traditional Initial Coin Offerings (ICOs) to create a more secure and democratic way of raising capital for new projects. DAICOs aim to provide better governance and investor protection in the often volatile landscape of crypto ventures. In this article, we will uncover the merits and challenges associated with DAICOs and their potential to disrupt traditional funding mechanisms.

The Genesis of DAICOs

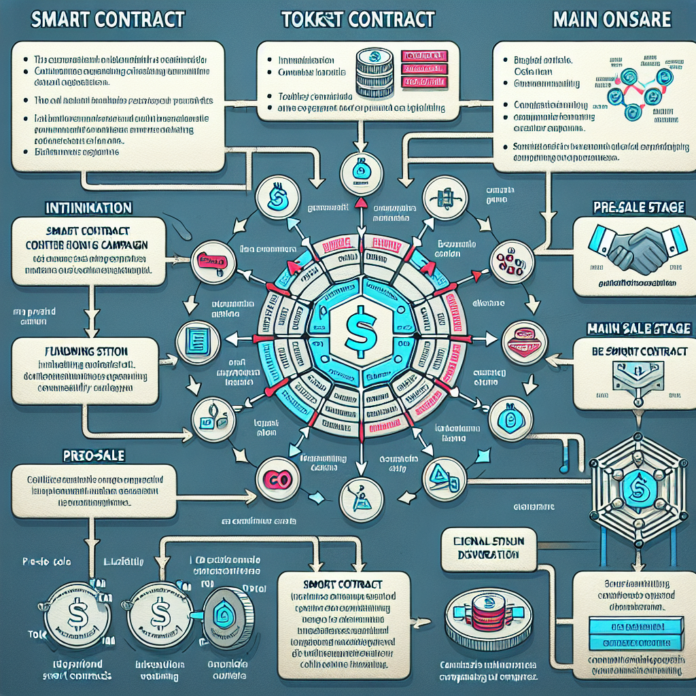

The DAICO concept was introduced by Vitalik Buterin, the co-founder of Ethereum, as a way to mitigate the risks associated with ICOs. While ICOs have been successful in providing a decentralized funding model, they have been plagued by scams, lack of accountability, and regulatory scrutiny. A DAICO, in contrast, incorporates smart contract protocols that give investors more control over the release of funds. This is intended to ensure that developers are held accountable to project milestones and objectives.

Merits of DAICOs

- Investor Control Over Funds: DAICOs offer investors the ability to vote on the release of funds to developers based on the project’s progress. Websites like Aragon provide a decentralized infrastructure that can be utilized to execute such governance features within a DAICO, promoting a higher level of transparency and confidence.

- Reduced Risk of Fraud: With more control in the hands of investors and the paced release of capital, there is a reduced risk of fraudulent activities. This increased scrutiny compels project teams to stay committed to their roadmap and deliverables.

- Democratic Decision-Making: The built-in voting systems of DAICOs provide a more democratic process, allowing token holders to make collective decisions about the future of the project, including the potential for a refund if the team fails to deliver.

Challenges of DAICOs

- Complexity of Smart Contract Design: Crafting a DAICO requires intricate smart contract development to ensure the voting rights and fund release mechanisms cannot be exploited. OpenZeppelin contracts are often used as a secure foundation for such projects but require adequate knowledge to adapt and integrate into a DAICO’s unique needs.

- Limited Regulatory Framework: While DAICOs aim to improve upon the traditional ICO model, there is still a limited regulatory framework to govern them, potentially causing legal uncertainties and challenges for both investors and project teams.

- Risk of Slow Funding: The controlled release of funds, while reducing the risk of mismanagement, can also lead to slower project development. This can deter investors who are accustomed to the quicker pace of traditional ICOs.

- Potential for Low Voter Turnout: Similar to real-world democratic systems, DAICOs may suffer from low voter turnout, which can impact collective decision-making and slow down the funding process.

- Technical Barriers for Investors: The concept and operation of DAICOs can be too technical for the average investor, limiting participation to those with a deeper understanding of blockchain technology and smart contracts.

The Road Ahead for DAICOs

Despite the challenges, the promise of a more secure and transparent fundraising mechanism makes DAICOs an intriguing model for the crypto community. As blockchain innovations evolve, platforms like Ethereum continue to provide fertile ground for the development and improvement of DAICOs.

Conclusion

DAICOs represent a significant step forward in the crowdfunding landscape, blending decentralized governance and investor-led control into a promising new model for raising capital. While the challenges are non-trivial, the merits suggest a paradigm shift in how ideas can be funded in a trustworthy and democratic manner. As this new concept continues to gain traction, it will undoubtedly inspire further innovation and maturation in the realm of crypto finance.

AGF-B.CO

AGF-B.CO