Introduction:

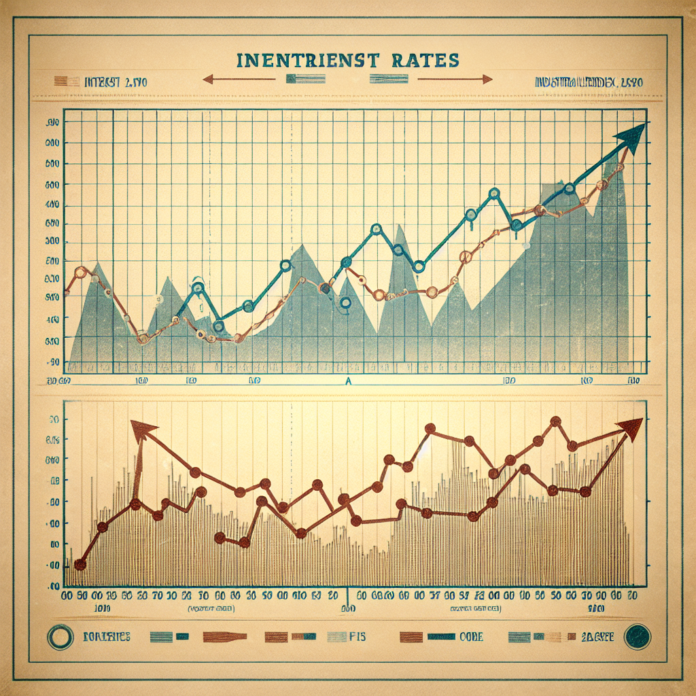

The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock market indexes in the world. As with any financial market, the performance of the Dow is influenced by various factors, including interest rates set by central banks. Changes in interest rates can have a profound impact on the stock market, and understanding the Dow’s sensitivity to interest rate hikes can be crucial for investors. In this article, we will examine the tactical relationship between the Dow Jones and interest rate hikes and highlight companies providing insights into this dynamic.

- Federal Reserve:

The Federal Reserve, the central banking system of the United States, plays a critical role in setting interest rates. The decisions made by the Federal Reserve’s Open Market Committee (FOMC) can significantly impact the stock market, including the Dow Jones. Monitoring the Federal Reserve’s announcements and reports can provide valuable insights into the potential direction of interest rates and their potential effects on the Dow.

External Link:

- Federal Reserve: Visit the Federal Reserve’s official website to access their statements, reports, and economic data, helping investors analyze the potential impact of interest rate hikes on the Dow Jones.

- Bloomberg:

Bloomberg is a renowned financial information and media company that provides real-time news, market updates, and analysis. Their platform provides valuable insights into market movements, including how the Dow Jones may react to interest rate changes. By monitoring Bloomberg’s news articles and analysis, investors can gain a better understanding of the potential strategies and tactics that can be employed during periods of interest rate hikes.

External Link:

- Bloomberg: Explore Bloomberg’s website for real-time news, market analysis, and insights into the relationship between interest rate hikes and the Dow Jones, enhancing investors’ tactical decision-making process.

- J.P. Morgan Asset Management:

J.P. Morgan Asset Management is a leading global investment management firm that offers a wealth of research and market commentary. Their expert analysis can provide valuable insights into the historical relationship between interest rate hikes and the Dow Jones. By studying their research, investors can gain a tactical understanding of market dynamics during periods of changing interest rates and potentially adjust their investment strategies accordingly.

External Link:

- J.P. Morgan Asset Management: Visit J.P. Morgan Asset Management’s website to access their research and market commentary, helping investors analyze the tactical implications of interest rate hikes on the Dow Jones.

Conclusion:

The Dow Jones Industrial Average’s sensitivity to interest rate hikes underscores the importance of understanding the relationship between these two factors. Companies such as the Federal Reserve, Bloomberg, and J.P. Morgan Asset Management offer valuable insights and analysis on this relationship. By staying informed about interest rate changes and monitoring expert opinions, investors can make more tactical decisions when it comes to managing their Dow Jones investments during periods of interest rate hikes.

AGF-B.CO

AGF-B.CO