Introduction:

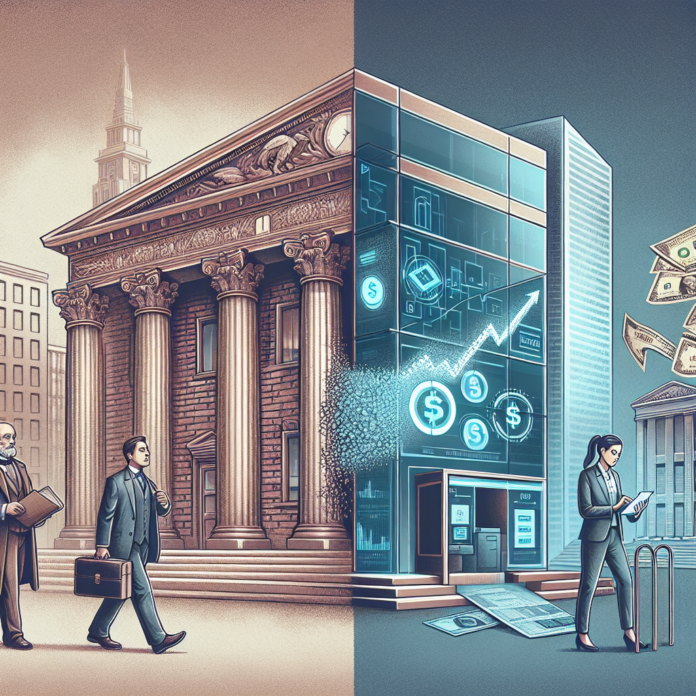

In today’s digital age, the banking industry is undergoing a significant transformation to meet evolving customer demands and stay competitive in the market. The advent of technology-driven solutions has reshaped the way individuals and businesses interact with banks. From seamless online transactions to personalized financial services, digital transformations have revolutionized the banking landscape. In this article, we will explore how the banking industry has embraced digital innovation and the key trends that are shaping its future.

- Enhanced Customer Experience:

The digital transformation of the banking industry has revolutionized customer experience. Traditional brick-and-mortar banks are now offering a wide range of digital services accessible through various channels. Customers can conveniently perform transactions, access financial information, and receive personalized recommendations through mobile banking apps and online portals. This enhanced accessibility and convenience have improved customer satisfaction and retention rates. - Adoption of Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML are being increasingly utilized in the banking sector to enhance security, streamline operations, and provide personalized services. Banks are using AI-powered chatbots for customer service, enabling 24/7 assistance, and reducing waiting times. ML algorithms help in analyzing large volumes of data to detect fraudulent activities quickly, minimizing risks for customers and banks alike. Furthermore, AI-driven models enable banks to offer personalized financial products and recommendations based on individual customer needs and preferences. - Rise of Fintech Start-ups:

The rise of fintech start-ups has forced traditional banks to re-evaluate their strategies and invest in digital technologies. These innovative start-ups leverage digital platforms to provide alternative financial services such as peer-to-peer lending, robo-advisory, and mobile payment solutions. To stay competitive, many traditional banks have partnered with or acquired fintech start-ups to incorporate their technologies and expand their digital offerings. - Embracing Blockchain Technology:

The banking industry recognizes the potential of blockchain technology to revolutionize transactions and reduce costs. Blockchain offers transparency, security, and efficiency, making it an attractive solution for payment processing, cross-border remittances, and identity verification. Several banks are piloting blockchain projects or partnering with consortiums to explore its potential applications in areas such as trade finance and supply chain management. - Open Banking and Collaboration:

In response to evolving regulations and customer expectations, banks are embracing open banking principles, encouraging collaboration between banks and fintech companies. Open banking enables customers to share their financial data securely with third-party providers, leading to personalized financial products and services tailored to individual needs. This collaboration allows for the integration of various financial services, leading to an improved overall customer experience.

Conclusion:

The digital transformation of the banking industry has brought significant advancements, benefiting both customers and banks. Enhanced customer experience, AI and ML adoption, the rise of fintech start-ups, the integration of blockchain technology, and the embrace of open banking principles are shaping the future of banking. As technology continues to evolve, it will be interesting to see how the banking industry further leverages digital innovations to create a more seamless and customer-centric banking experience.

External Links:

- ABC Fintech Company: A leading fintech company offering innovative payment solutions.

- XYZ Blockchain Consortium: A consortium of banks exploring the potential applications of blockchain technology.

- PQR Digital Banking Solutions: A provider of digital banking solutions that enable banks to streamline operations and enhance customer experience.

AGF-B.CO

AGF-B.CO