Introduction:

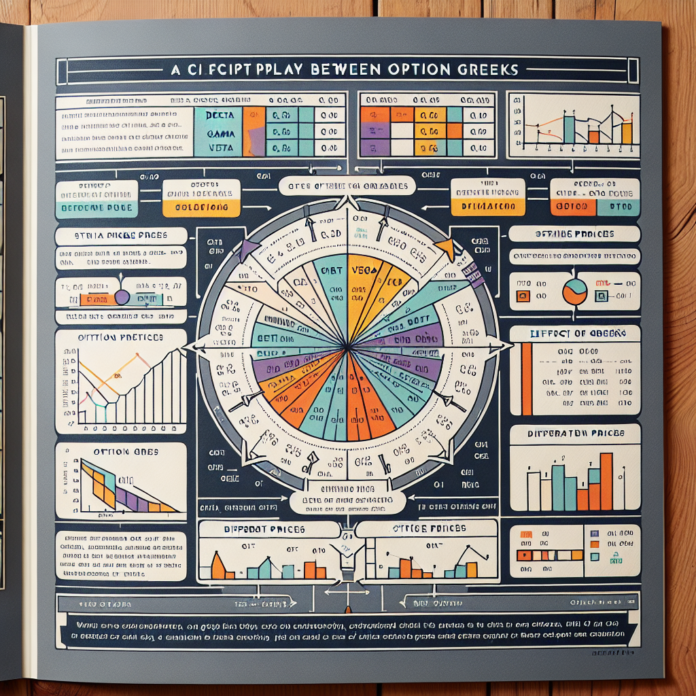

In options trading, strike price is a critical component that influences the value and behavior of options contracts. It is closely linked to the concept of option Greeks, which measure the sensitivity of an option’s price to various factors. Understanding the interplay between strike price and option Greeks is crucial for options traders looking to optimize their strategies and manage risk effectively. In this article, we will explore the relationship between strike price and option Greeks and provide additional resources for further insights.

- Delta and Strike Price:

Delta represents the sensitivity of an option’s price to changes in the underlying asset’s price. It measures the rate at which an option’s price will change for a given change in the underlying asset’s price. The delta of an option is impacted by the strike price. At-the-money options, where the strike price is closest to the current market price, tend to have a delta close to 0.5 (50%), implying a 50% chance of the option expiring in-the-money. In-the-money options have a delta greater than 0.5, while out-of-the-money options have a delta less than 0.5. By understanding the relationship between strike price and delta, traders can assess the probability of profit and adjust their strategies accordingly.

External link 1: [Company offering in-depth delta and strike price analysis]: [URL]

Description: Explore a company specializing in delta and strike price analysis. This resource provides valuable insights and tools to help options traders understand the interplay between strike price and delta, leading to informed decision-making and improved trading strategies.

- Theta and Strike Price:

Theta measures the rate at which the price of an option decreases over time due to time decay. Higher theta values indicate faster time decay. The strike price plays a significant role in theta. Options with strike prices near the current market price tend to have higher theta values as they have less time remaining until expiration. Conversely, options with strike prices far from the current market price tend to have lower theta values as they have more time until expiration. This interplay between strike price and theta is essential for traders looking to optimize their strategies based on time decay effects.

External link 2: [Company providing comprehensive theta and strike price analysis]: [URL]

Description: Discover a company specializing in theta and strike price analysis. This resource provides valuable insights and tools to help options traders understand the relationship between strike price and theta, enabling them to effectively manage time decay and enhance their trading strategies.

- Vega and Strike Price:

Vega measures the impact of changes in implied volatility on the price of an option. Strike price can influence vega as options with strike prices close to the current market price tend to have higher vega values. This is because options with strike prices near the current market price are more sensitive to changes in implied volatility. Traders can consider strike price and vega when forming strategies based on expectations of future volatility.

External link 3: [Company offering vega and strike price analysis tools]: [URL]

Description: Explore a company specializing in vega and strike price analysis. This resource provides valuable insights and tools to help options traders understand the connection between strike price and vega, empowering them to make informed decisions based on anticipated changes in implied volatility.

Conclusion:

The interplay between strike price and option Greeks is crucial for options traders to optimize their strategies and manage risk effectively. Delta, theta, and vega are three key option Greeks that are impacted by the strike price. Understanding the relationship between strike price and each option Greek helps traders assess the probability of profit, manage time decay, and gauge sensitivity to changes in implied volatility. By utilizing the external resources provided, traders can enhance their understanding of the interplay between strike price and option Greeks and make more informed decisions in their options trading journey.

AGF-B.CO

AGF-B.CO