Introduction:

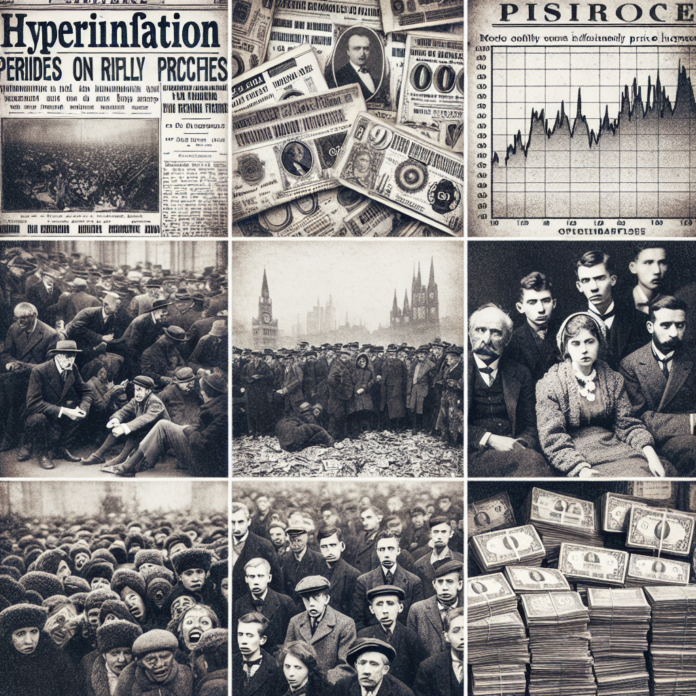

Hyperinflation is an extreme form of inflation that can have devastating effects on economies and individuals. Understanding the causes, consequences, and historical instances of hyperinflation can provide important insights into the risks associated with such economic scenarios. In this article, we will explore the concept of hyperinflation and provide links to companies that offer resources and historical examples for a deeper understanding of this phenomenon.

- What is Hyperinflation?

Hyperinflation refers to a situation where prices rise uncontrollably, leading to a rapid erosion of the value of money. This often occurs due to excessive money supply, typically as a result of government deficits or loose monetary policies. Hyperinflation can have severe consequences, including skyrocketing prices, loss of savings, and economic instability. Consider the following resources for a comprehensive understanding:

- Investopedia: Investopedia provides a detailed explanation of hyperinflation, its causes, and its impact on economies and individuals. This resource can help readers grasp the fundamental concepts and dynamics of hyperinflation.

Website: www.investopedia.com

- Federal Reserve Bank of St. Louis: The Federal Reserve Bank of St. Louis offers articles and research papers that delve into the root causes and economic implications of hyperinflation. It provides historical context and explores policy responses to mitigate hyperinflationary risks.

Website: www.stlouisfed.org

- Historical Instances of Hyperinflation:

Examining past cases of hyperinflation can provide valuable insights into the causes, consequences, and lessons learned from these extreme economic events. Familiarizing oneself with historical examples can help individuals and policymakers understand the warning signs and take proactive measures to prevent hyperinflation. Consider exploring the following resources:

- Weimar Germany (1921-1923): The hyperinflation experienced by Weimar Germany is one of the most notable instances in history. It can serve as a cautionary tale, providing lessons on the consequences of excessive money printing and the devastating effects on the population.

- Zimbabwe (2007-2009): Zimbabwe’s hyperinflation period serves as a more recent example. This case highlights the consequences of a collapsing economy, widespread poverty, and the need for immediate corrective measures.

- Venezuela (ongoing since 2016): Venezuela’s ongoing hyperinflation crisis demonstrates the long-term ramifications of economic mismanagement, including scarcity of goods, collapsing infrastructure, and mass migration.

- Learning from Historical Examples:

Studying historical instances of hyperinflation can help individuals and policymakers develop strategies to mitigate the risks associated with such events. Understanding the underlying causes, policy responses, and long-term consequences can be crucial for preserving wealth and promoting economic stability. Consider the following resource for a deeper dive into historical hyperinflation events:

- The Great Hyperinflation: The Great Hyperinflation is a comprehensive online resource that provides detailed accounts of historical hyperinflation episodes from around the world. It offers valuable insights into the causes, experiences, and impacts of hyperinflation, enhancing understanding and awareness of this economic phenomenon.

Website: www.greathyperinflation.com

Conclusion:

Understanding hyperinflation and its historical instances is essential to recognize the warning signs and potential risks associated with this extreme economic phenomenon. Resources such as Investopedia and the Federal Reserve Bank of St. Louis provide detailed explanations and analysis to deepen your knowledge of hyperinflation. Historical cases like Weimar Germany, Zimbabwe, and Venezuela offer real-world examples of the devastating consequences of hyperinflation. The Great Hyperinflation resource offers a comprehensive overview of historical hyperinflation episodes to further enhance your understanding. By studying these instances, individuals and policymakers can be better equipped to identify and address hyperinflation risks, promoting economic stability and protecting wealth.

Disclaimer: The external links provided in this article are for reference purposes only, and their inclusion does not signify endorsement or affiliation with the companies mentioned. Always exercise caution when visiting external websites and consult with reputable economic experts for personalized advice on hyperinflation-related matters.

AGF-B.CO

AGF-B.CO