The landscape of cryptocurrency mining is one of high rewards, potentially matched by high risks, particularly due to the volatility associated with mining profitability. For both new entrants to the market and seasoned miners, understanding the factors that lead to profit fluctuations is critical to making informed decisions.

What Influences Mining Profitability?

The profitability of crypto mining pivots on a delicate balance of several factors, including cryptocurrency prices, the efficiency of mining hardware, operational costs, network difficulty, and block reward halvings.

Cryptocurrency Market Prices

The most direct influence on mining profitability is the real-time value of cryptocurrencies. As digital assets are infamous for their price volatility, the margin of mining profits can swing dramatically in tandem with market sentiment and external economic factors.

Mining Hardware Efficiency

Efficient mining hardware can make the difference between profit and loss. Over time, the effectiveness of mining equipment degrades, and manufactures such as Bitmain continually release newer models that pressure miners to upgrade to remain competitive.

Operational Costs

Electricity costs remain the most substantial operational expenditure for miners. Geographical location plays a significant role, and miners must often seek out regions with low-cost electricity to maintain profitability margins.

Network Difficulty and Hashrate

As more miners compete for block rewards, the network difficulty adjusts to maintain consistent block confirmation times. Profitability can take a hit as the increasing total hashrate within a network such as Bitcoin results in higher difficulty and, consequently, a need for more computational power to sustain earnings.

Block Reward Halvings

Periodic block reward halvings, as part of many cryptocurrencies’ monetary policy, reduce the number of coins miners receive for validating a block. Halvings can significantly impact profitability if price increases do not offset the reduced rewards.

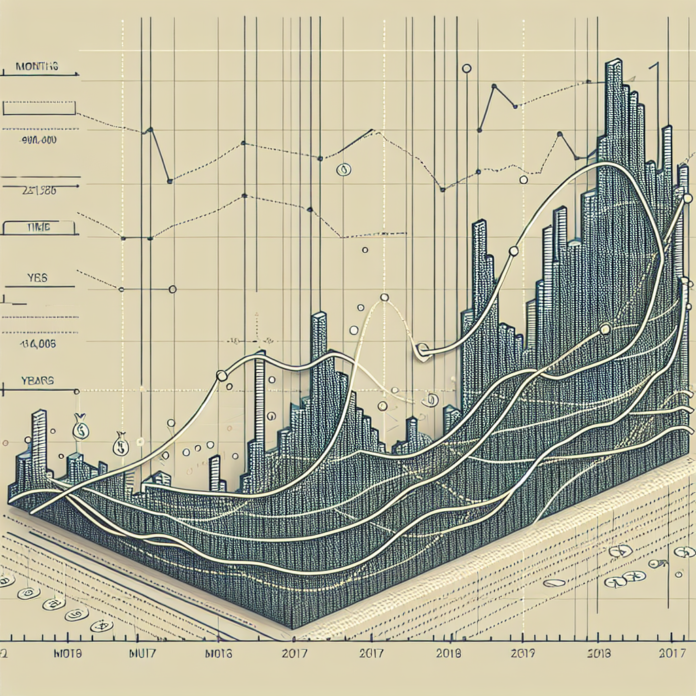

Evaluating Profit Volatility Over Time

Understanding and monitoring these factors allow miners to assess how profit volatility shifts over time and to make adjustments as needed.

Profitability Calculators

Online profitability calculators like those from CryptoCompare are indispensable tools for miners. They allow real-time assessment of potential earnings, accounting for current conditions and personal overheads.

Mining as a Long-Term Investment

Mining should often be approached with a long-term perspective, aware that short-term profitability may experience dips but can be balanced by future market upswings.

Historical Data Analysis

Looking at historical data can offer insight into trends and potential future behavior. Websites like Blockchain.com provide detailed analytics about network difficulty, hashrates, and transaction fees, which can be valuable in predicting profitability patterns.

Adapting Strategies for Sustained Profitability

Diversification

Savvy miners diversify their mining activities across different cryptocurrencies to mitigate risks associated with any single network.

Cost-Effective Upgrades

Balancing the timing of hardware upgrades with market conditions can help maintain profitability without incurring unnecessary expenses.

Renewable Energy Sources

Investing in renewable energy sources or relocating operations to areas with cheaper power can reduce the impact of electricity costs on profits.

Conclusion

Mining profitability is not static; it’s subject to a constellation of volatile factors that demand constant vigilance and adaptation. By keeping a finger on the pulse of the cryptocurrency market and managing operational efficiencies, miners can navigate the turbulence of profit volatility and seek sustained success in the mining arena.

Remember that mining is a complex and sometimes unpredictable venture. Always carry out thorough research or engage with financial experts before making significant investment decisions in mining operations.

AGF-B.CO

AGF-B.CO