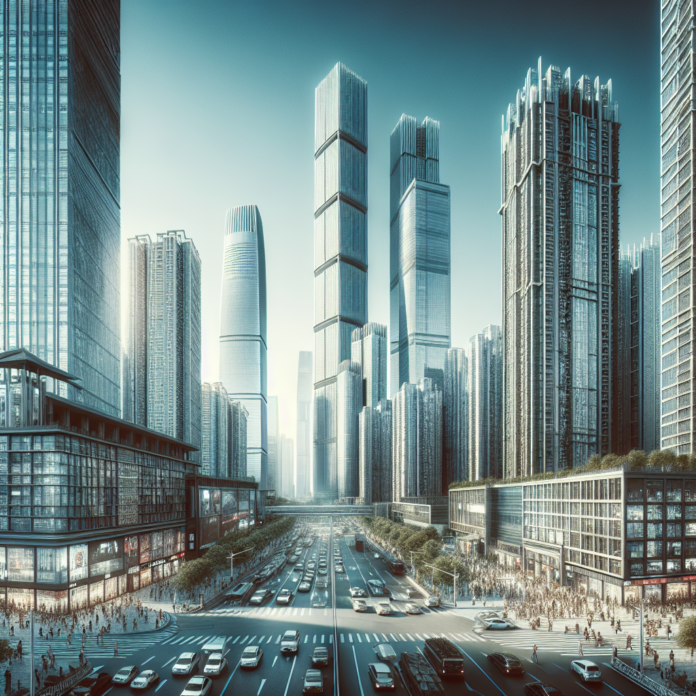

The Chinese real estate market has been one of the most dynamic and compelling sectors of the country’s economy. However, it is also a market fraught with challenges and volatility, which significantly impacts the performance of Chinese real estate equities. Investing in this sector requires a keen understanding of the market forces at play and the ability to identify potential risks and opportunities in the portfolios of leading Chinese real estate companies.

The Role of Real Estate in China’s Economy

Real estate has traditionally been a key driver of China’s economic growth, with significant capital tied up in property development and investment. Yet, changes in regulatory frameworks and economic policies can affect the market massively. The Chinese government’s efforts to control property speculation and manage debt levels, for example, have prompted a slowdown in certain segments of the market.

Major Players in the Chinese Real Estate Space

- China Vanke Co. Ltd: As one of China’s largest property developers by sales, China Vanke has weathered market fluctuations with a mix of residential, commercial, and rental properties. The company’s adaptability to market trends and diversification strategies are reflected in its equity performance.

- Country Garden Holdings: Known for its high-volume building projects, Country Garden has been actively involved in expanding its international presence. Its portfolio includes a mix of residential properties, integrated townships, and properties supporting the tourism industry.

- Evergrande Group: Evergrande has been making headlines due to its debt crisis, which is indicative of the broader challenges facing Chinese real estate developers. Its equities have been particularly volatile, illustrating the potential risks inherent in this sector.

Regulatory Environment and Policy Shifts

China’s real estate market is significantly influenced by government policies, which aim to stabilize the market, contain housing prices, and manage the levels of leveraged debt within the industry. Investors in real estate equities must stay informed on policy shifts, such as the introduction of the “three red lines” policy that caps debt for developers, which can affect the profitability and viability of real estate projects.

The Impact of Economic Cycles

Economic cycles greatly impact the real estate market, and Chinese equities are no exception. Periods of economic prosperity can lead to bullish property markets, while downturns can result in oversupply and declining asset values. Investors must analyze macroeconomic indicators to position their portfolios effectively within this sector.

Opportunities in Market Corrections

While the Chinese real estate market faces short-term volatility and long-term regulatory challenges, opportunities still exist. Market corrections can present entry points for investors seeking undervalued equities. Cautious analysis and a clear understanding of a company’s financial health, project pipeline, and management competency are essential.

Conclusion

The Chinese real estate equities market offers a unique combination of opportunity and risk, reflective of the sector’s central role in the country’s economic narrative. Companies operating within this space are subject to a complex interplay of regulatory policies, economic forces, and market dynamics. Investors interested in this sector must diligently research and continuously monitor developments to navigate the market effectively, positioning themselves to capitalize on the growth potential while mitigating risks.

AGF-B.CO

AGF-B.CO