The stock market is far from static—it’s characterized by regular fluctuations that can impact investor returns. These fluctuations are known as market cycles, and they represent the expansive and contracting phases of the market over time. Understanding how these cycles work and the forces that drive them is key to managing investment strategies and making informed decisions. This article delves into the mechanics of market cycles and provides insights into how investors can navigate these changes for better investment outcomes.

Understanding Market Cycles

Market cycles refer to the periodic and cyclical nature of the financial markets, including bull markets (periods of rising prices) and bear markets (periods of falling prices). These cycles can be influenced by a variety of factors, including economic indicators, interest rates, global events, and investor sentiment.

Analysts and economists often rely on resources such as the National Bureau of Economic Research (NBER), which offers tools and data for understanding these economic cycles and their potential impacts on the stock market.

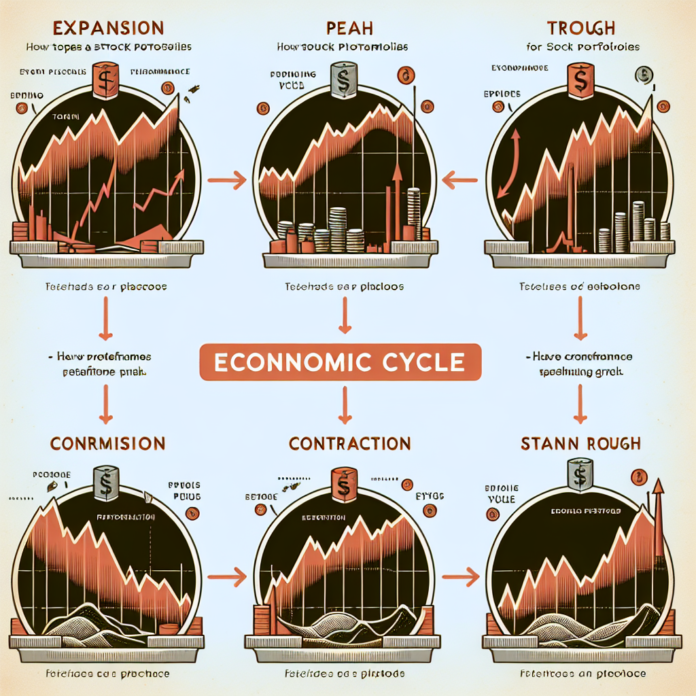

The Four Phases of a Market Cycle

- Accumulation: This phase marks the beginning of an upward trend, often following a bear market when savvy investors start purchasing stocks at low prices despite negative sentiment.

- Markup: Following accumulation, more investors begin to notice the momentum, driving prices higher.

- Distribution: As stock prices peak, informed investors start to sell or reduce their holdings, and market sentiment can shift from bullish to more cautious.

- Markdown: Prices begin to fall, and widespread selling ensues, reinforcing the downward trend leading back to the accumulation phase.

The transitions between these phases can be analyzed using financial news and analysis from platforms like Bloomberg, which provide minute-to-minute market insights.

Factors Affecting Market Cycles

Several key factors can influence market cycles, including:

- Economic Data: Employment numbers, GDP growth, and manufacturing data can provide insight into the health of the economy and potentially the direction of stock markets.

- Central Bank Policies: Decisions by institutions like the Federal Reserve regarding interest rates and monetary policy significantly influence market cycles.

- Global Events: Geopolitical tensions, trade agreements, and international affairs can cause market volatility and impact market cycles.

- Market Sentiment: Investor psychology plays a crucial role in driving the markets. When investors are optimistic, markets tend to rise; when they are pessimistic, markets can fall.

Investing Through Market Cycles

To capitalize on market cycles, investors can consider several strategies:

- Long-Term Investing: Staying invested over the long term, riding out short-term fluctuations, which can be a sound strategy for those not looking to actively trade market cycles.

- Market Timing: Some investors attempt to time the market, buying low during the accumulation phase and selling high during the distribution phase. This approach can be risky, as timing the market is notoriously challenging.

- Sector Rotation: During different market cycles, certain sectors may outperform others. Rotation strategies involve shifting investment to sectors likely to outperform during a given phase of the cycle.

Research and advisory firms like Morningstar can provide valuable analysis and ratings to help investors make better decisions and understand which sectors may be due for growth or retraction.

Risks and Rewards

Investors need to be aware that market cycles bring both risks and rewards. While they offer opportunities to maximize returns, misjudging these cycles can result in significant losses. Therefore, combining an understanding of market cycles with a diversified portfolio and a well-thought-out investment plan is advisable.

Conclusion

Market cycles are an inherent part of stock investing, and they demand respect and understanding from investors. By recognizing the phases and their effects, and by harnessing the analytics and insights provided by industry resources and experts, investors can navigate market cycles with greater confidence and poise, ultimately striving for more successful investment outcomes.

AGF-B.CO

AGF-B.CO