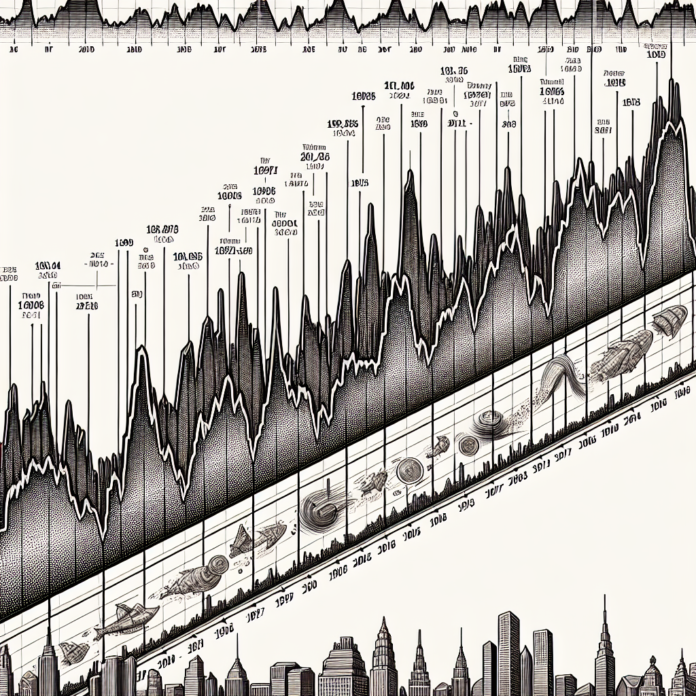

The Dow Jones Industrial Average (DJIA), known colloquially as the Dow, serves as one of the oldest barometers of the American stock market’s health. Since its inception in 1896, the Dow has traversed the peaks and valleys of economic prosperity and recession, reflecting the long-term growth and performance of the industrial sector—and, by extension, the American economy. This article examines the century-plus performance of the DJIA and offers insights into its long-term trends.

The Early Years: Setting the Stage for Growth

In the early 20th century, the Dow Jones Industrial Average started with a mere 12 companies, a far cry from today’s 30 diverse constituents. Historical analyses from firms such as Charles Schwab indicate that despite numerous economic upheavals, including the Great Depression, the DJIA has showcased an undeniable upward trajectory over the decades.

Post-War Boom and Technological Contributions

Following World War II, the United States experienced significant industrial growth, which positively impacted the performance of the Dow. Industry leaders and market historians from S&P Global have chronicled the impact of technological innovation and the expansion of the middle class on the performance of the Dow, noting how these market drivers reflected the optimism and growth of the era.

Bear Markets and Corrections: Tests of Resilience

The long-term narrative of the Dow Jones is punctuated by periods of bear markets and corrections. Market analysts from Investopedia provide insights into how the index has weathered economic storms such as the oil crisis of the 1970s, the dot-com bubble burst at the turn of the millennium, and the 2008 financial crisis. Each of these events tested the resilience of the Dow, and yet, the index has historically rebounded to new heights over time.

The 21st Century: A Landscape of Diversification and Global Influence

As the DJIA entered the 21st century, its composition reflected a broader range of sectors, incorporating technology giants and service industry leaders. A consulting article by Deloitte Insights discusses the ongoing evolution of the Dow’s constituents and how this diversification has better positioned the index to mirror the modern economy.

The Dow’s Performance and the Future

Analyzing the historical data and long-term trends, the Dow Jones Industrial Average has provided investors with significant returns, albeit with periods of volatility. Investment firms like Vanguard offer resources that highlight the compound annual growth rate (CAGR) of the index, emphasizing the power of long-term investment and the average annual return investors have gained.

Conclusion

The long-term performance of the Dow Jones Industrial Average tells a story of American economic endurance and growth. Despite periods of pronounced volatility, the index has shown a general upwards trajectory, emphasizing the potential benefits of long-term investing. Understanding the Dow’s history—not merely its day-to-day fluctuations—can provide investors with a clearer picture of market movements and the broader economic trends at play.

Tags: #DowJones, #LongTermPerformance, #StockMarketHistory, #MarketTrends, #EconomicGrowth, #CharlesSchwab, #SPGlobal, #Investopedia, #DeloitteInsights, #Vanguard

AGF-B.CO

AGF-B.CO